Teachers pages now on Unisciences

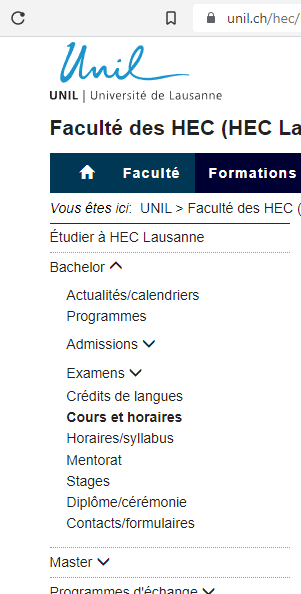

New Embeded Timetables

Please find Courses and timetables directly in your

Study program

Please find the Units charts now in Unisciences

Please find the Units charts now in Unisciences

![[logo_unil.png]](https://hecnet.unil.ch/medias/plone/lg14/logo_unil.png)